Clarity Money

Clarity Money is an iOS budget app that helps you control your finances in many ways, from cancelling wasteful subscriptions to creating a savings account. Aside from that, it also alerts you if you are spending more than your allotted budget in different areas of your finances. For example, if you are buying more groceries than you’re supposed to buy, the app will remind you before you spend.

Clarity Money uses artificial intelligence to analyse your spending habits. It uses the data it acquires to create a financial goal for you with a specific target date. Aside from controlling your spending habits, the app also helps you lower your bills by cancelling needless accounts and finding a lower credit card.

Mint

Mint is a budgeting app created by the same team who created TurboTax and Quicken. The app is available for both Android and iOS users. Mint creates a personalised budget for you based on the financial data you have. It also notifies you of unusual charges and advises you on how to reduce the money you spend on your monthly bills and fees. Most of all, it shows your credit score so that you will know the overall condition of your finances. All you have to do is connect your bank to the Mint app and let it do the dirty work for you.

What makes Mint standout over other apps is its investment tracker feature which helps users compare their portfolio with the market benchmarks as well as track all their asset allocations across all platforms, such as their mutual funds and 401(k).

Mvelopes

Mvelopes is a budgeting app that uses the envelope system and is available for iOS and Android users. The developer of Mvelopes believes that financial freedom does not come with a bigger paycheck but from how you manage your money. Therefore, it helps you manage your money by setting up a monthly financial plan for you based on your income. Aside from that, it also helps you manage your credit card spending as well as eliminate all hidden spending you might have.

In case you have difficulty with managing your finances, the Mvelopes team provides financial coaching and education on money management. Get professional advice from their Certified Budgeting Coaches and receive tools that will help you build your savings and eliminate your debts.

Unsplurge

Unsplurge is another iOS budget app but works with a different twist. It lets you save for something you love or look forward to. It works on the principle of delayed gratification where you save for something which you can splurge on later, like a vacation in France or a new car. Unsplurge also has a social network where you can share your goals and progress to the community, your family or your friends. These people act as your cheerleaders and motivators as they cheer you up for every goal met or encourage you in case you are lagging behind.

Good Budget

Good Budget is a budget app that uses the envelope system of budgeting. The only difference is that you don’t have to carry a bunch of envelopes with you. Just like the paper envelope system, you start by placing a certain amount of money for each expense that you have, such as groceries, petrol, transportation, eating out, among others.

One of its notable features is that it allows you and your spouse to sync your accounts so that both of you stay on the same page of the budget you have set for the family. The app lets you know who’s spending the money, where it is going and how much is left in each envelope. Good Budget is available on iOS and Android.

Level Money

Level Money is both an iOS and Android budget app which allows you to save money by telling you how much you can spend each day, week and month. It works like a GPS for your finances because it lets you know exactly where you are and gets you where you want to go financially.

Instead of just tracking your expenses and budget, it analyses how much money you have in your budget and calculates how much you can spend. If you have to purchase something bigger than your given budget, the app helps you plan how to do that. It also does the same way for your debt repayment.

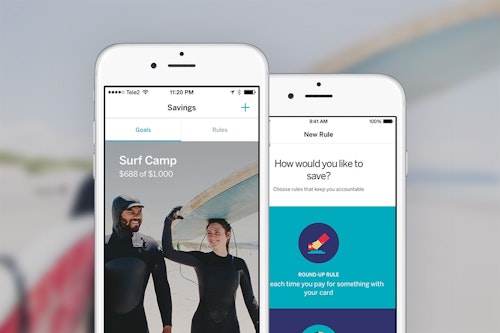

Qapital

Qapital is a unique budget app because it charges your guilty pleasures and automatically puts the money you don’t use to your savings. It also enables you to set rules for your savings and identify the triggers of your expenses. For example, it reminds you to set aside a certain percentage of your income every time you receive payment from a client, an essential feature, especially for freelancers.

Aside from that, it rewards you every time you spend less than your budget or resist buying things you want to cut back by putting that unconsumed money straight into your account. On the other hand, if you spend more, it penalises you, which is also a plus for your savings.

All you need to do is open free savings account through Qapital. After that, create a savings goal and a trigger for your automatic savings. Lastly, link your bank account so that you can easily transfer money every time the rules and triggers are activated. Qapital is available for both iOS and Android users.

#Takeaway

Virtual reality

Virtual reality is best described as an illusion of reality created by a computer system.

A person may enter a world of virtual reality by putting on special glasses and headphones attached to a computer system running the virtual reality programme.

According to www.techterms.com, these devices immerse the user with the sights and sounds of the virtual world. Some virtual reality systems allow the user to also wear gloves with electronic sensors that can be used to touch or move virtual objects. As the user moves his head or hands, the computer moves the virtual world accordingly in real-time.

Virtual reality has been widely used for entertainment purposes, but the technology has found its way into the military and medical fields as well. While virtual reality systems have advanced significantly over the past decade, for the most part they are still more “virtual” than reality.